Argen bill payment professional#

If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. Make sure you have the information for the right year before making decisions based on that information. Some of the information on this website applies to a specific financial year. If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

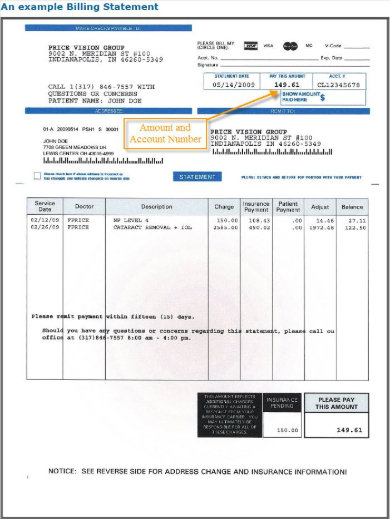

Details for paying us including PRN, payment slips, processing times and fees that may apply. The payment details will be displayed on your card statement as 'ATO payment' and 'Card payment fee – ATO'. When you pay using any of our card payment services, we'll give you a receipt number.

is a percentage of the amount being paid, based on the type of card.Card terms and conditions Card payment fee Registered agents can use Online services for agents External Link to print payment options for their clients – on the Client summary page select Accounts summary > Payment options.

Argen bill payment update#

phone 13 28 61 to order an ATO notice with an income tax payment slip – you'll need your tax file number (TFN) to use this service.īefore we can discuss your details or update your records, you must establish your identity.

phone 13 28 66 to order an activity statement with payment slip – you'll need your Australian business number (ABN) and be an authorised representative of the business to use this service.Select Print-friendly version to print the payment slip. Choose the account required, then click Payment options, then select BPAY or Other payment methods.Select Accounts and payments from the menu, then Accounts Summary.Payment slips are generally available on notices of assessment or statements of account.īusiness taxpayers can print a payment slip using Online services for business External Link: Make sure you have the correct payment slip for the account you want to pay. You'll need a payment slip to pay at the post office. Once we receive your payment, it may take a further four business days to be allocated to your ATO account. If you mail a cheque or money order to us, you will need to take into account postal service delivery times External Link. Payments made electronically or at Australia Post may take up to four business days to appear on your ATO account, from the date you make the payment. obtain your PRN from ATO notices or payment slips.Registered agents – payment reference number on the Client summary page select Accounts summary > Payment options.Registered agents – log in to Online services for agents External Link Select payments then select BPAY or Other payment methods.Select Accounts and payments from the menu.Individuals and sole traders – log in to your myGov account linked to the ATO External Link and select Tax > Accounts > Summaryīusinesses – log in to Online services for business External Link and:.You can go online to get your payment reference number: Using an incorrect PRN could result in delays to payments being credited to your account and unnecessary debt collection activity. Make sure you use the right PRN for the type of tax you're paying. For example, income tax and activity statements. You will have different payment reference numbers for different types of tax. Your unique payment reference number (PRN) ensures your payment is credited to the correct account. This page provides payment details you may need when making payments to us.

0 kommentar(er)

0 kommentar(er)